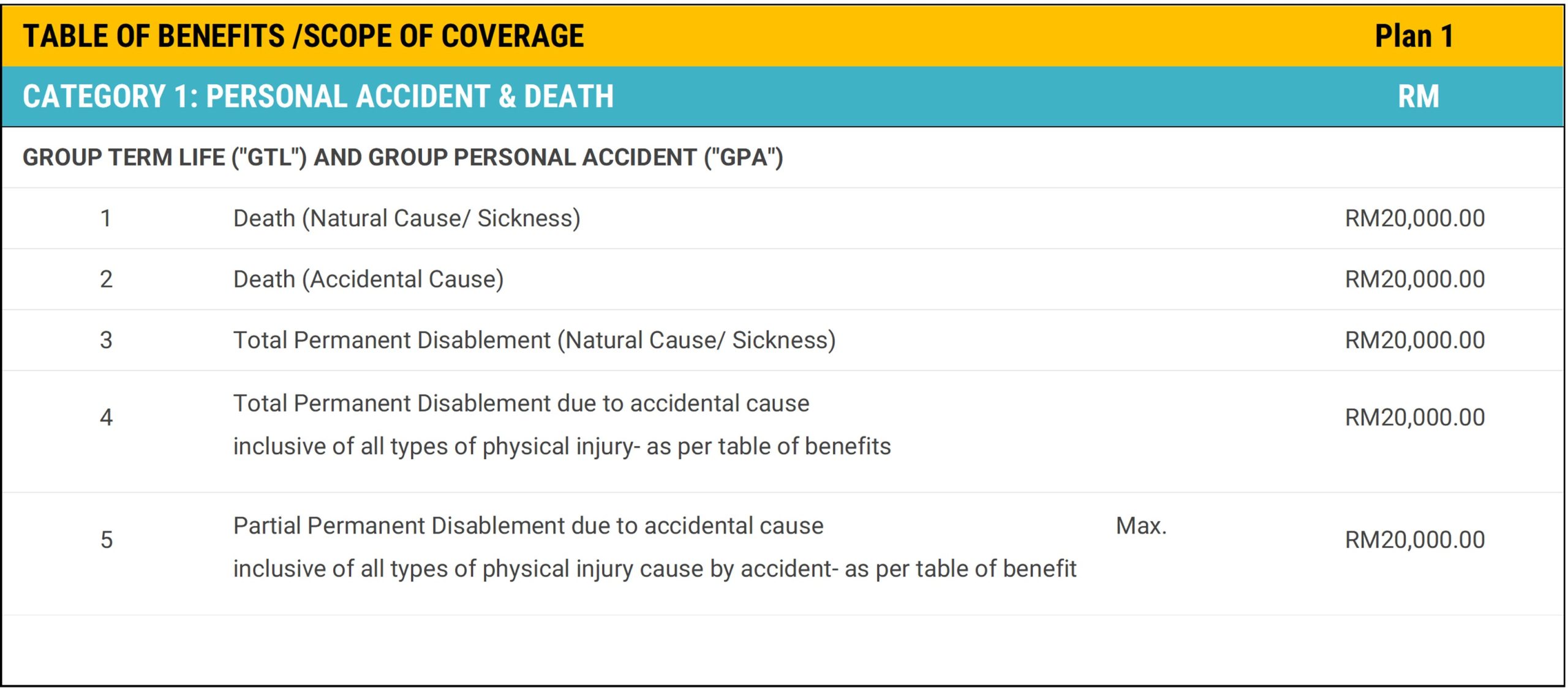

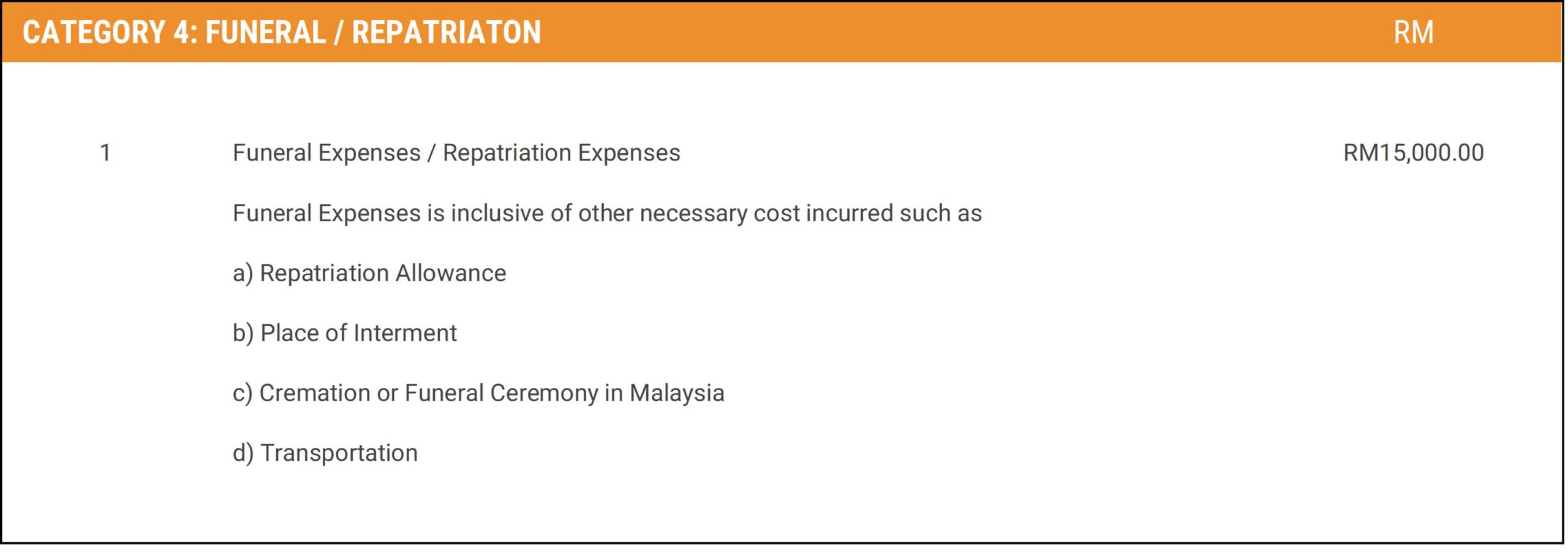

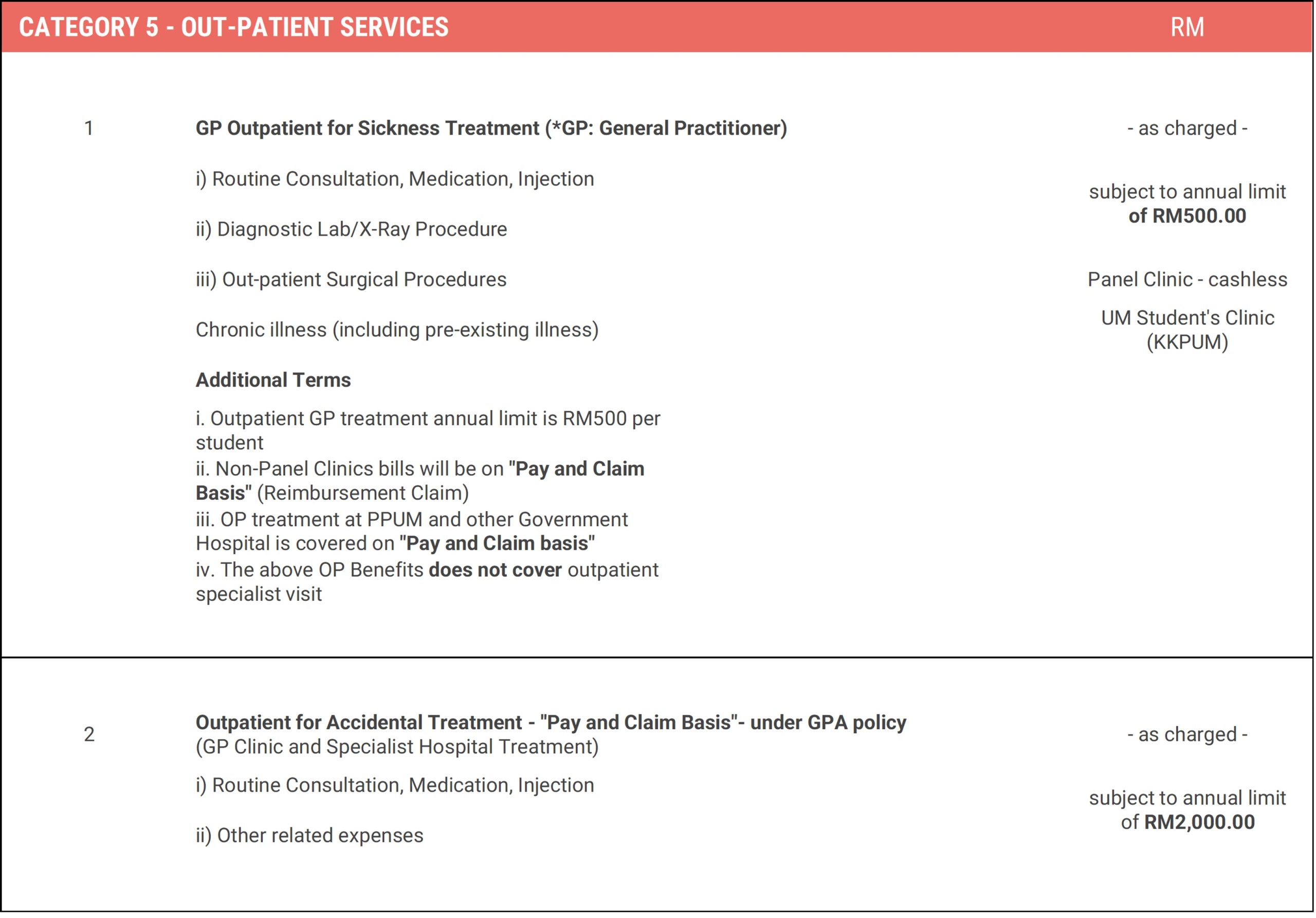

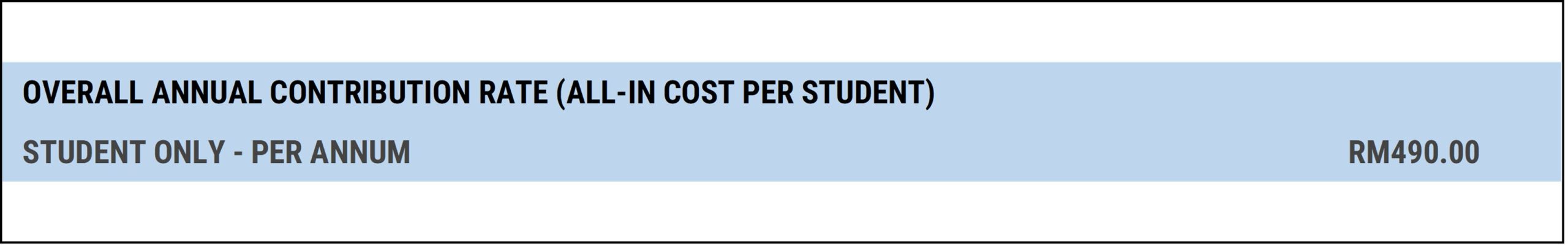

Insurance Plan

NOTES:

- The above coverage is to be extended to UM International students is subject to our policy terms, conditions and exclusions as specified in the Policy Contract.

- The contribution will be charged on pro-rate basis for those students joining the plan after 31 March.

Our Services

Main Menu